As the U.S.-China chip trade war enters its fifth year, a new study reveals that China is outpacing the United States in next-generation semiconductor research, potentially undermining U.S. efforts to maintain its technological edge through export controls. According to a report by Georgetown University's Emerging Technology Observatory (ETO), China has published more than double the number of semiconductor-related research papers compared to the U.S. between 2018 and 2023, signaling a significant shift in the global semiconductor landscape.

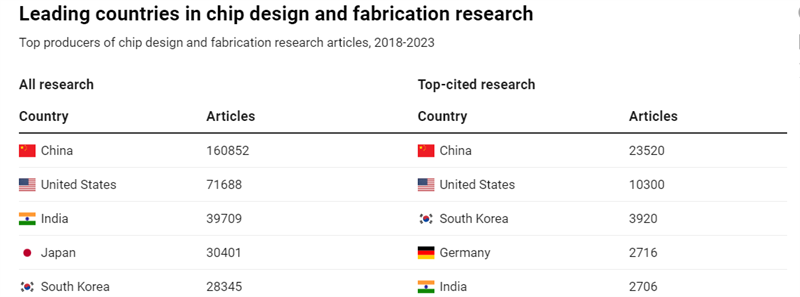

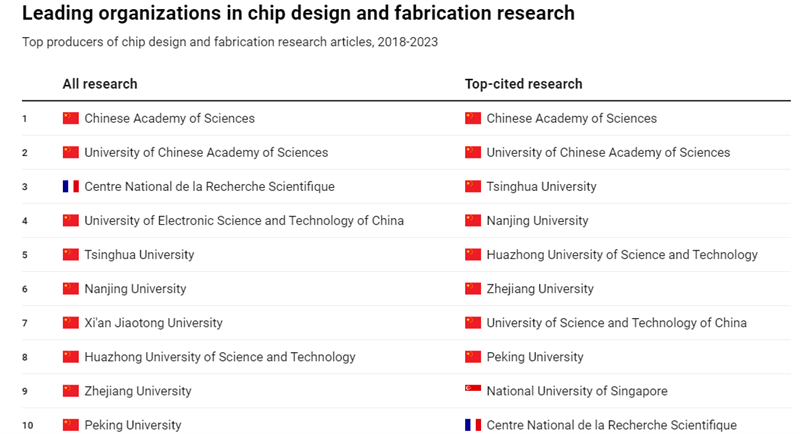

The ETO analysis, which examined 475,000 papers on chip design and fabrication, found that Chinese institutions accounted for 34% of global research output, far surpassing the U.S. (15%) and Europe (18%). Notably, China's research quality is also rising, with 50% of the top 10% most-cited papers originating from Chinese researchers, compared to 22% from the U.S. and 17% from Europe.

Zachary Arnold, a senior analyst at ETO, highlighted the implications of China's research dominance in an interview with Nature: “When you see so much activity, it's hard to imagine that won't have an effect on China's technological capability and ultimately manufacturing capability in the coming years.”

China's focus on cutting-edge technologies such as neuromorphic computing (processors modeled after neural structures) and optoelectric computing (using light for data transfer within chips) positions it to leapfrog traditional semiconductor manufacturing constraints. These “post-Moore's Law” innovations lie outside the scope of current U.S. export controls, which target advanced chipmaking equipment for nodes below 14nm.

Since 2022, the U.S. has imposed stringent sanctions on China's access to advanced semiconductor tools, citing national security concerns. However, these measures may prove ineffective against China's growing expertise in next-generation architectures. For instance, research by Chen Yunji, a professor at the Beijing National Processor Research Institute, has been cited over 10,000 times on Google Scholar, with 41% of citations coming from U.S. researchers.

Jacob Feldgoise, an ETO analyst, warned that if China successfully commercializes its research, U.S. export controls could become irrelevant. “The technologies China is focusing on do not require existing manufacturing technologies monopolized by the U.S.,” he said. “If China succeeds, it won't just catch up—it may surpass the U.S.”

Meanwhile, the global semiconductor industry faces a potential oversupply of mature chips as China redirects its efforts toward legacy technologies amid U.S. sanctions. However, China's relentless research momentum suggests it may soon develop chipmaking capabilities beyond Western knowledge.

The U.S.-China tech rivalry shows no signs of abating, with both nations escalating tensions through measures like TSMC's $100 billion U.S. investment, China's push for RISC-V architecture, and new tariffs. While the long-term outcome remains uncertain, China's strides in semiconductor research could reshape the global balance of power in the industry.

As the ETO report concludes, China's research dominance challenges the narrative that it relies solely on stolen technology. With eight of the world's top-cited semiconductor research institutions based in China, the nation is poised to redefine the future of chipmaking—and the U.S. may struggle to keep pace.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday