The U.S. government is reportedly preparing to extend its restrictions on the export of advanced artificial intelligence (AI) chips to include more countries, particularly in Southeast Asia and the Middle East. This move aims to prevent China from acquiring these critical technologies by limiting access to AI chips used in powerful computing infrastructures.

The new export control measures, expected to be announced soon, will build on existing restrictions that have been in place since October 2022, when the Biden administration implemented a series of stringent measures to block China’s access to top-tier semiconductors and related technology. These efforts were aimed at limiting China’s military and surveillance capabilities, with a focus on AI technologies.

The latest round of restrictions will include tighter controls on the sale of AI chips to countries in Southeast Asia and the Middle East. These regions have been seen as backdoor routes for China to bypass direct chip purchases from the U.S. Companies in countries such as Singapore have reportedly engaged in illegal activities, smuggling AI chips like those from Nvidia into China. Additionally, Chinese firms have established branches in these regions to circumvent U.S. export restrictions.

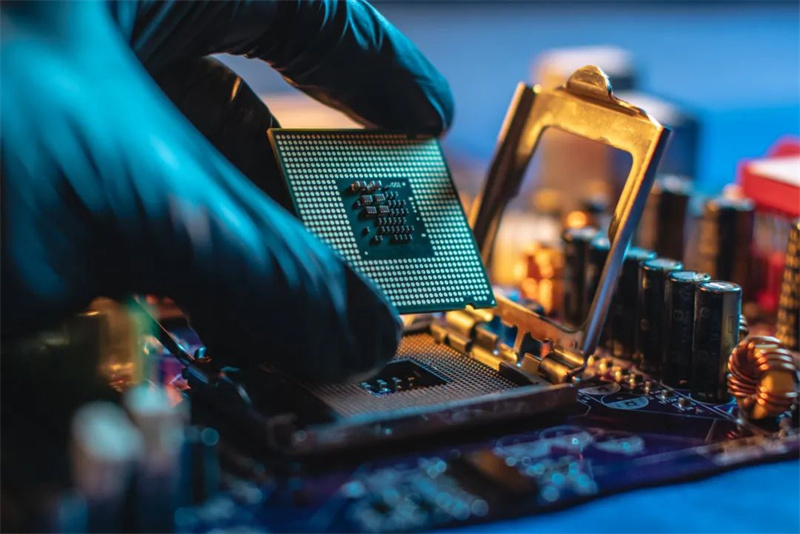

While allies of the U.S. with close diplomatic ties, such as Japan and the Netherlands, are expected to be exempt from these new rules, countries in Southeast Asia and the Middle East will face stringent quotas on chip purchases, especially those critical for AI data centers, such as GPUs (graphics processing units). These chips are essential for training and running large-scale AI models and will now be under tighter controls.

The U.S. government has reportedly been working closely with companies like TSMC and Samsung Electronics, instructing them to secure licenses before they can sell advanced chips to China. These measures are set to further disrupt the global semiconductor supply chain and complicate the international trade dynamics, as both China and other countries in the targeted regions seek alternatives.

At the same time, the U.S. is reportedly preparing to involve major cloud service providers like Google and Microsoft in the effort to enforce these new AI chip regulations. These companies would act as “gatekeepers,” ensuring that AI chips are not funneled into the hands of "bad actors," particularly in China, by providing AI capabilities through cloud services while adhering to the new export rules.

Despite these aggressive measures, some experts argue that such restrictions may ultimately backfire. Rather than stifling China’s technological advancements, the restrictions are likely to accelerate efforts within China to develop its own AI and semiconductor industries, reducing dependence on foreign technology. China’s push for self-reliance in these critical sectors is gaining momentum, making it less vulnerable to external disruptions.

As the global AI chip market continues to expand rapidly, with revenues expected to grow by 33% in 2024, the pressure on chip manufacturers is intensifying. Companies like Nvidia, AMD, and others in the U.S. and around the world are seeking to capture their share of this lucrative market, even as Washington tightens its grip on exports. The complex, interconnected nature of the semiconductor industry makes these new policies challenging to enforce and risks alienating key allies, who may view these measures as an overreach of U.S. power.

If implemented, the expanded restrictions will test the balance between national security concerns and global trade cooperation, and could have profound implications for the future of the semiconductor industry and the international tech ecosystem. The U.S. must carefully weigh the long-term consequences of these measures, as they could shift the global tech balance and impact American companies’ ability to compete on the world stage.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday