TTM Technologies, Inc.(NASDAQ: TTMI), a leading global manufacturer of technology solutions including mission systems, radio frequency (“RF”) components and RF microwave/microelectronic assemblies, and printed circuit boards (“PCB”), reported results for the second quarter fiscal 2023, which ended on July 3, 2023.

Second Quarter 2023 Highlights

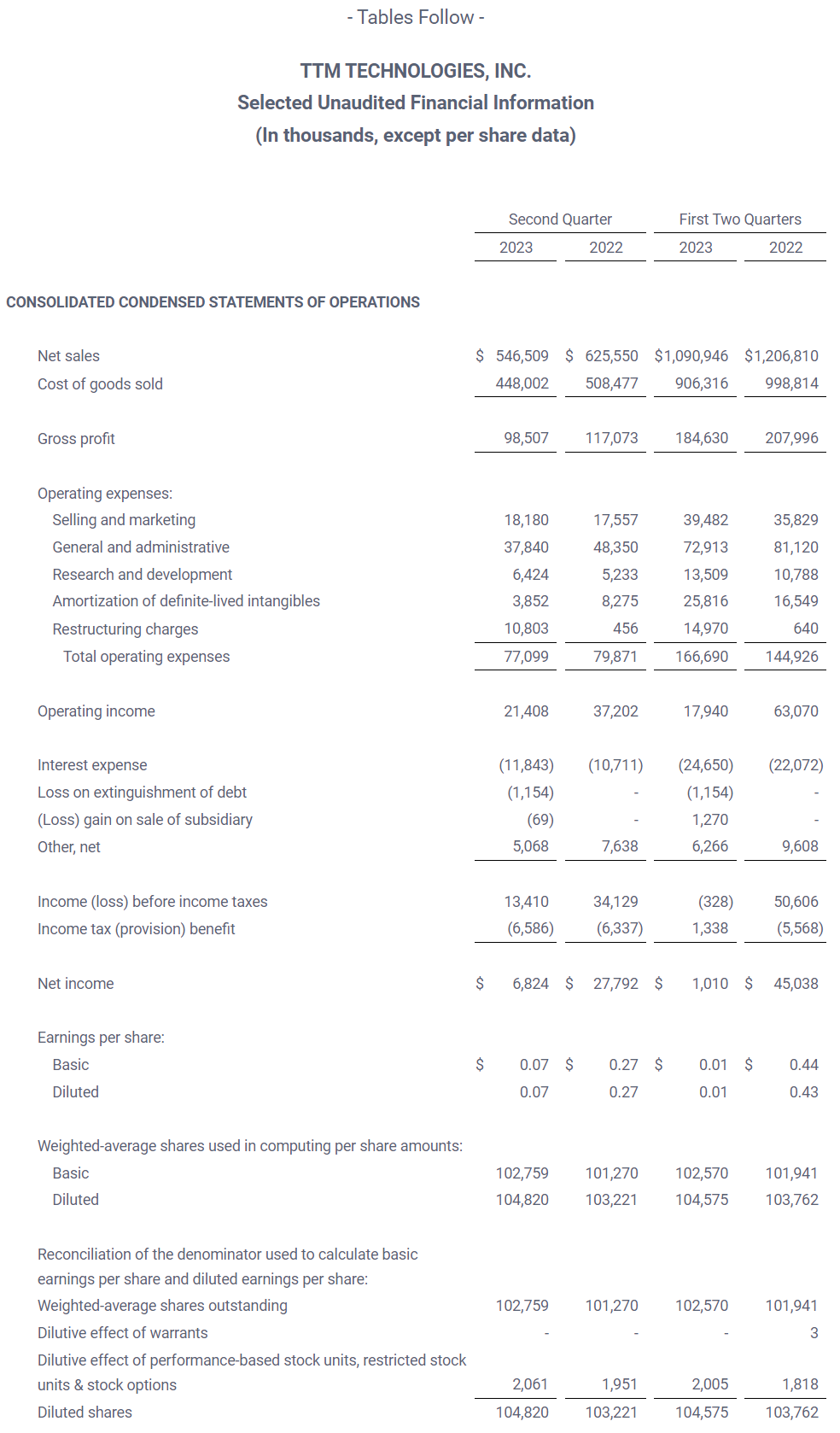

●Net sales were $546.5 million

●GAAP net income of $6.8 million, or $0.07 per diluted share

●Non-GAAP net income was $33.0 million, or $0.32 per diluted share

●Completed refinancing of Term Loan B, US Asset Backed Revolving Credit Facility (“ABL”), and Asia ABL facility

●Completed shutdown of Hong Kong manufacturing facility

Second Quarter 2023 GAAP Financial Results

Net sales for the second quarter of 2023 were $546.5 million, compared to $625.6 million in the second quarter of 2022.

GAAP operating income for the second quarter of 2023 was $21.4 million, compared to GAAP operating income of $37.2 million in the second quarter of 2022.

GAAP net income for the second quarter of 2023 was $6.8 million, or $0.07 per diluted share, compared to GAAP net income of $27.8 million, or $0.27 per diluted share in the second quarter of 2022.

Second Quarter 2023 Non-GAAP Financial Results

On a non-GAAP basis, net income for the second quarter of 2023 was $33.0 million, or $0.32 per diluted share. This compares to non-GAAP net income of $55.3 million, or $0.54 per diluted share, for the second quarter of 2022.

Adjusted EBITDA in the second quarter of 2023 was $74.7 million, or 13.7% of sales compared to adjusted EBITDA of $96.9 million, or 15.5% of sales for the second quarter of 2022.

“Revenues were within the guided range due to strength in our Aerospace and Defense and Data Center Computing end markets,” said Tom Edman, CEO of TTM. “Non-GAAP EPS was well above the guided range as a result of improved execution in our North America region. In addition, we successfully completed the refinancing of our Term Loan B, US ABL, and Asia ABL facilities, resulting in a conservative capital structure with no significant maturities before 2028 and a net leverage ratio of 1.5x,” concluded Mr. Edman.

Business Outlook

For the third quarter of 2023 , TTM estimates that revenues will be in the range of $550 million to $590 million, and non-GAAP net income will be in the range of $0.25 to $0.31 per diluted share.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday