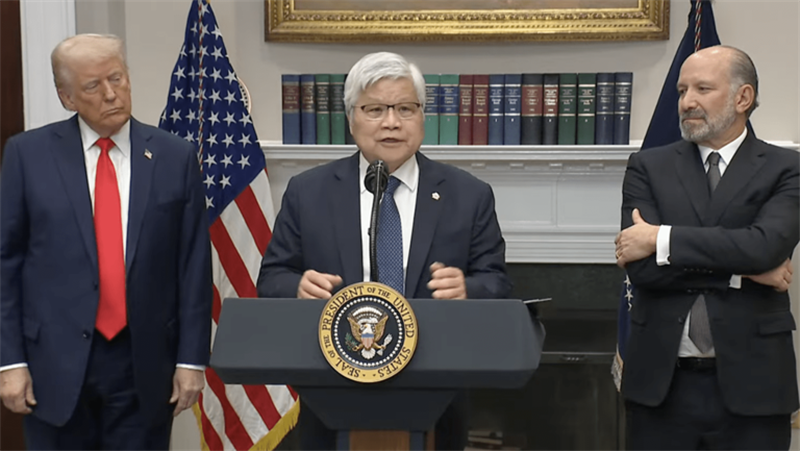

On March 3, U.S. local time, TSMC Chairman C.C. Wei, alongside U.S. President Donald Trump, announced that the semiconductor giant plans to invest an additional $100 billion in advanced semiconductor manufacturing in the United States. This new commitment builds on TSMC's existing $65 billion investment in Arizona, bringing its total U.S. investment to a staggering $165 billion.

The announcement marks a significant escalation in TSMC's U.S. operations, which began in 2020 with a $12 billion investment in Arizona during Trump's first term. Under the Biden administration's CHIPS and Science Act, TSMC expanded its plans, committing $40 billion in 2023 to build a second fab in Arizona. By April 2024, the company announced a third fab, increasing its total investment to $65 billion and creating over 25,000 direct and indirect jobs. These facilities aim to help the U.S. produce 20% of the world's most advanced logic chips by 2030.

The three fabs will include a 4nm facility already in production, a 3nm fab delayed to 2028, and a third fab producing 2nm or more advanced chips by the late 2020s. The Biden administration has pledged $6.6 billion in subsidies and $50 billion in low-interest loans under the CHIPS Act to support TSMC's expansion. In January 2024, TSMC CFO Wendell Huang confirmed the company had received its first $1.5 billion subsidy installment.

However, the Trump administration has criticized the CHIPS Act's subsidy approach, favoring tariffs to incentivize foreign semiconductor investment. Trump has expressed dissatisfaction with U.S. reliance on Taiwan for chips, threatening tariffs on Taiwanese imports. “They don't need money; they need incentives,” Trump said, suggesting tariffs of 25% to 100% could compel companies like TSMC to invest in the U.S. without subsidies.

Despite these tensions, TSMC's latest expansion is expected to generate $200 billion in economic output over the next decade.

TSMC's Arizona campus, spanning 1,100 acres, already employs 3,000 workers and began 4nm production in late 2024. The new facilities will strengthen the U.S. semiconductor ecosystem and bolster AI supply chains, with key customers like Apple, NVIDIA, AMD, and Qualcomm benefiting from the increased capacity.

While TSMC's expansion is a boon for the U.S., it poses challenges for Intel, which is struggling financially and now faces a formidable competitor on its home turf. Meanwhile, TSMC's move diversifies its production away from Taiwan, mitigating risks from natural disasters and geopolitical tensions with China.

As TSMC solidifies its U.S. presence, the semiconductor landscape is shifting, with tariffs and subsidies shaping the future of global chip manufacturing.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday