The market for Integrated Circuit (IC) substrates is experiencing rapid growth and has become the fastest-growing sub-industry within the printed circuit board sector.

The global IC substrate industry grew by 39.4% in 2021, reaching a total size of $14.198 billion, and continued to grow in 2022 with a year-on-year increase of approximately 23%. Based on Prismark's analysis, the global IC substrate industry was expected to outperform the overall industry, with a compound annual growth rate of 8.6% from 2021 to 2026, and was estimated to reach a size of $21.435 billion by 2026.

There are 7 companies with IC substrates revenues exceeding 1 billion USD in 2021, namely:

① Unimicron: 2.08 billion USD

② Ibiden: 1.96 billion USD

③ Samsung Electro-Mechanics (SEMCO): 1.53 billion USD

④ Shinko: 1.39 billion USD

⑤ LG Innotek: 1.27 billion USD

⑥ Nanya PCB: 1.23 billion USD

⑦ Kinsus: 1.09 billion USD

Since 2016, the global top ten IC substrates manufacturers have basically locked in their positions due to high barriers to entry in terms of capital, technology, and customers, resulting in a situation where the strong get stronger. The manufacturers who have taken the lead in laying out the carrier board market have a very obvious first-mover advantage. Unimicron, Ibiden from Japan, and SEMCO from South Korea are the top three players in the market, with market shares of 15%, 11%, and 10%, respectively. IC substrate companies in mainland China are also growing, with major suppliers including Shennan Circuit, Fastprint Circuit, and ACCESS. More PCB manufacturers are also beginning to invest in IC substrates.

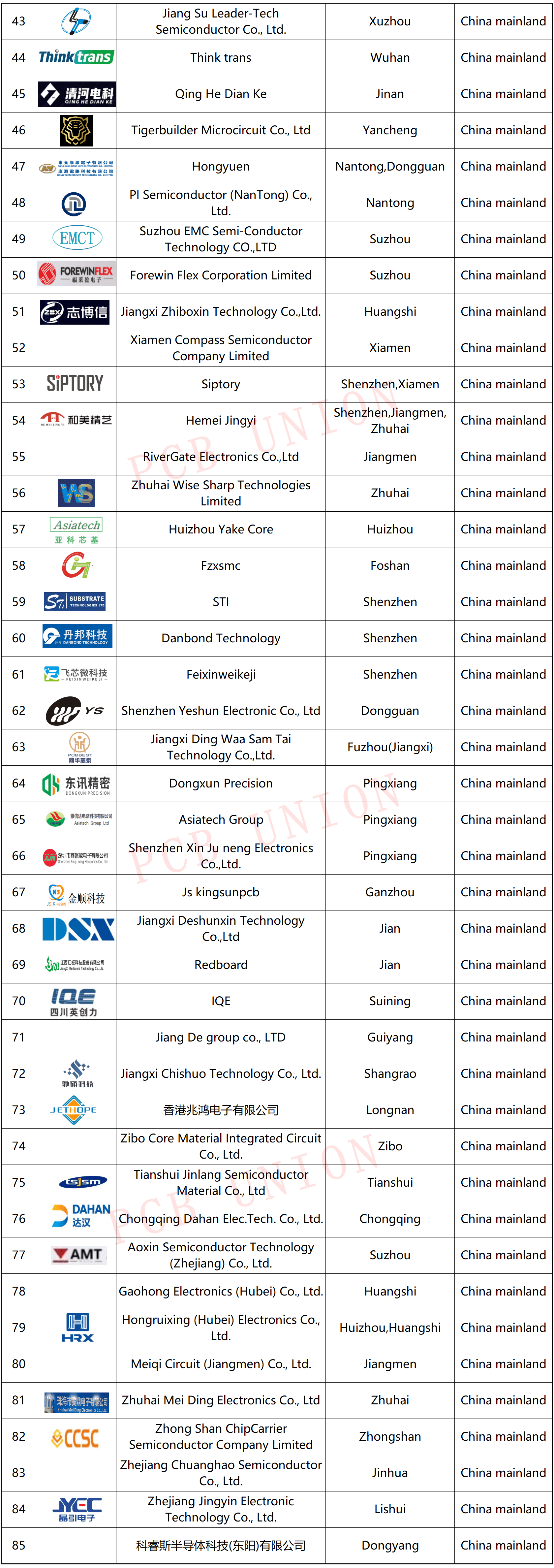

According to PCB UNION's incomplete statistics, below is a list of companies worldwide currently involved in IC substrates" for clarity (including those planning to invest in carrier board projects).

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday