The global semiconductor industry is set to embark on 18 new fab construction projects in 2025, according to SEMI's latest World Fab Forecast report. These projects include three 200mm and fifteen 300mm facilities, with most expected to begin operations between 2026 and 2027.

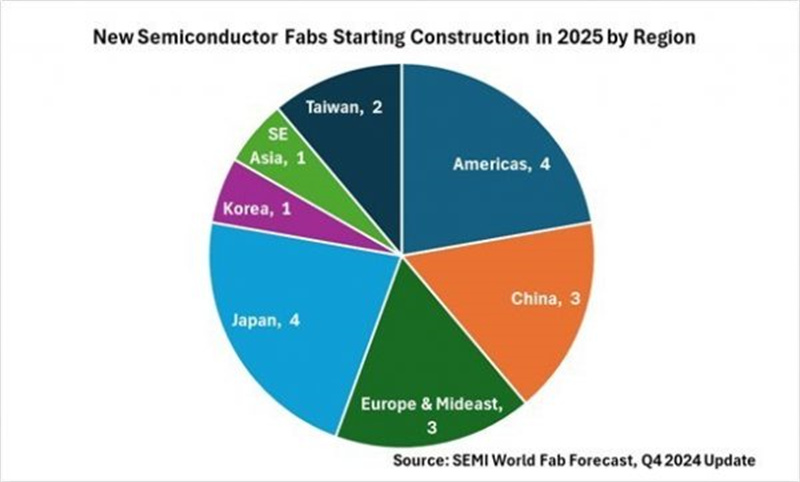

In terms of regional distribution, the Americas and Japan lead with four projects each, followed by China and Europe & the Middle East, each with three. Taiwan will see two projects, while Korea and Southeast Asia have one each.

Ajit Manocha, SEMI President and CEO, commented:

“The semiconductor industry stands at a critical juncture, driven by investments in both leading-edge and mainstream technologies to meet evolving global demands. Generative AI and high-performance computing are advancing the logic and memory segments, while mainstream nodes continue to power applications in automotive, IoT, and power electronics. The 18 new fabs planned for 2025 reflect the industry's commitment to innovation and economic growth.”

Global Fab Expansion Through 2025

The World Fab Forecast report for Q4 2024 reveals that from 2023 to 2025, the semiconductor industry plans to bring 97 new high-volume fabs online, including 48 in 2024 and 32 in 2025. These projects span a range of wafer sizes from 300mm to 50mm, underscoring the industry's robust growth trajectory.

Advanced Nodes Driving Industry Growth

Semiconductor production capacity is projected to grow at a yearly rate of 6.6%, reaching 33.6 million wafers per month (wpm) by 2025. Leading-edge logic technologies, especially for high-performance computing (HPC) and generative AI applications, are the primary drivers of this expansion.

Advanced node capacities (7nm and below) are expected to see a rapid 16% annual growth, adding over 300,000 wpm to reach 2.2 million wpm in 2025. This growth reflects the increasing computational needs of applications such as large language models (LLMs) and edge AI devices.

Meanwhile, mainstream nodes (8nm to 45nm) are poised to grow by 6%, surpassing 15 million wpm in 2025. This growth is bolstered by demand from automotive and IoT markets and China's focus on semiconductor self-sufficiency.

In contrast, mature nodes (50nm and above) are expanding at a slower 5% annual rate, reflecting a conservative market recovery and lower utilization rates. This segment is expected to reach 14 million wpm in 2025.

Foundry and Memory Segments

Foundry suppliers continue to lead in capacity expansion, with an expected year-over-year growth of 10.9%. Foundry capacity is projected to rise from 11.3 million wpm in 2024 to a record 12.6 million wpm in 2025.

Memory capacity growth remains measured, with 3.5% growth forecast for 2024 and 2.9% for 2025. However, demand for high-bandwidth memory (HBM), fueled by generative AI applications, is reshaping the market. The DRAM segment is forecasted to grow by 7% year-over-year to 4.5 million wpm in 2025, while 3D NAND capacity is expected to increase by 5%, reaching 3.7 million wpm.

Industry Outlook

The December 2024 update of the SEMI World Fab Forecast lists over 1,500 facilities and production lines globally, including 180 high-volume fabs with varying probabilities of starting operations in 2025 or later.

These developments highlight the semiconductor industry's ongoing investment in innovation, positioning it to meet the increasing demands of AI, IoT, and other transformative technologies while driving substantial economic growth worldwide.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday