Nvidia posted a record revenue of $13.51 billion for the latest quarter ended July 30, up 88% from the first quarter and a whopping 101% from the same period in 2022 — sending its stock surging by as much as 10% in aftermarket trading on last Wednesday.

The eye-popping figures boosted Huang’s fortune to $42 billion from $38 billion, according to the Bloomberg Billionaires Index, positioning the 60-year-old Taiwanese businessman to end the year ranked within the world’s top 25 wealthiest people.

Nvidia shares inched up another 0.1% on last Thursday to close at $471.63 — adding another $200 million to his net worth.

Most of Huang’s fortune is made up from his 3.5% stake in Nvidia. Year to date, Nvidia’s share price has ballooned over 200%.

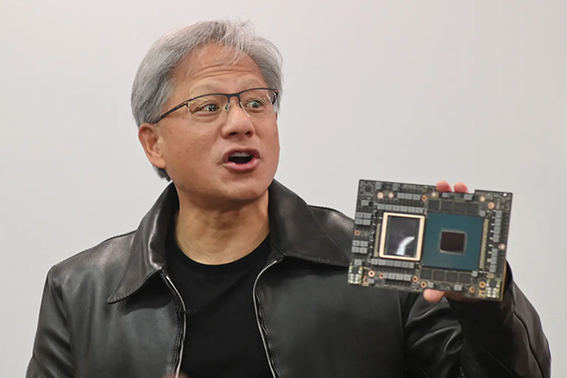

Huang established Nvidia in 1993 on his 30th birthday to bring three-dimensional graphics into the gaming and multimedia markets.

The Taiwanese-born tech whiz — who moved to Kentucky at age 9 — reportedly dreamed up the chip giant alongside fellow engineers Chris Malachowsky and Curtis Priem at a Denny’s restaurant in San Jose, Calif., where he had worked part-time before getting his masters degree from Stanford University.

Huang is reaping the benefits of his company’s success.

He reportedly lives in a $38 million, 9,000-square-foot mansion in San Francisco’s Pacific Heights — which boasts a rooftop deck, wine cellar, movie theater and gym — with his wife, Lori, who he met while getting his undergraduate degree at Oregon State University, and his two children, Spencer and Madison.

The California-based company’s chief financial officer, Colette Kress, said on an earnings call with investors that Nvidia “had an exceptional quarter,” noting that its $13.51 billion in revenue beat both Wall Street’s $12.6 billion estimate and the company’s own $11 billion prediction.

Kress, who also serves as Nvidia’s executive vice president, suggested that Nvidia won’t be slowing down, and told investors to expect $16 billion in revenue at the end of next quarter.

Analysts polled by Refinitiv on average were expecting $12.61 billion.

Adjusted revenue in the second quarter was $13.51 billion, compared with estimates of $11.22 billion.

Nvidia also posted record data center revenue of $10.32 billion — up 141% from the first quarter and a 171% increase from the year ago period.

The data center earnings also crushed analyst estimates of $7.69 billion by more than $2 billion, according to Refinitiv data.

Meanwhile, profits at Nvidia’s gaming segment rose to $2.49 billion.

Nvidia’s results were a “‘drop the mic’ moment in our opinion that will have a ripple impact for the tech space for the rest of the year,” said Daniel Ives, analyst at Wedbush Securities.

The company has been cashing in on the artificial intelligence boom with the creation of AI chips that can generate text for chatbots like ChatGPT, generate code and perform image, facial and speech recognition.

Nvidia’s AI chips are already used by providers like Amazon, Alibaba and Microsoft — companies that run some of the largest cloud-computing services out there.

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” Huang said.

Analysts have estimated that demand for Nvidia’s prized AI chips is exceeding supply by at least 50%, adding that the imbalance will stay in place for the next several quarters.

Thus, Nvidia is spending big to secure supply.

The company reported a 53% jump to $11.15 billion of inventory commitments from the previous quarter, largely because of the long-term supply needs for its data center chips.

Further informations on Nvidia from PCB UNION:

A $40,000 Nvidia Chip has Become the World's Most Sought-after Hardware

CoreWeave secures $2.3 billion in debt by pledging Nvidia H100 Nvidia chips as collateral

Doosan Chosen as Nvidia's Copper-Clad Laminate Supplier

Isu Petasys wins Intel, Microsoft and Nvidia as customers for server boards

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday