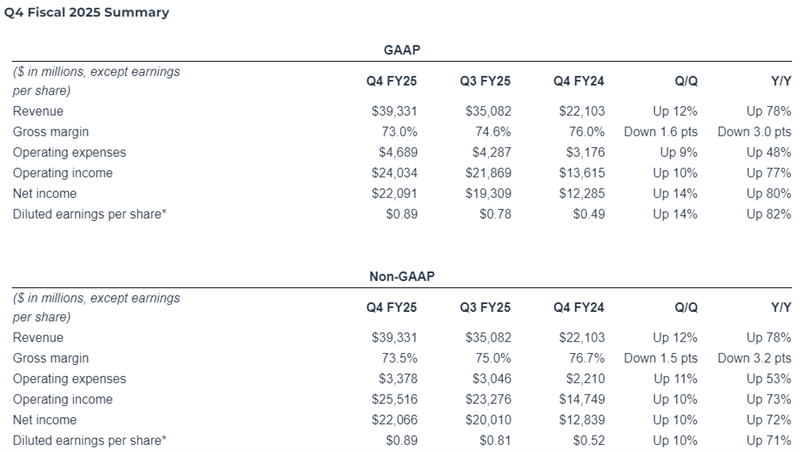

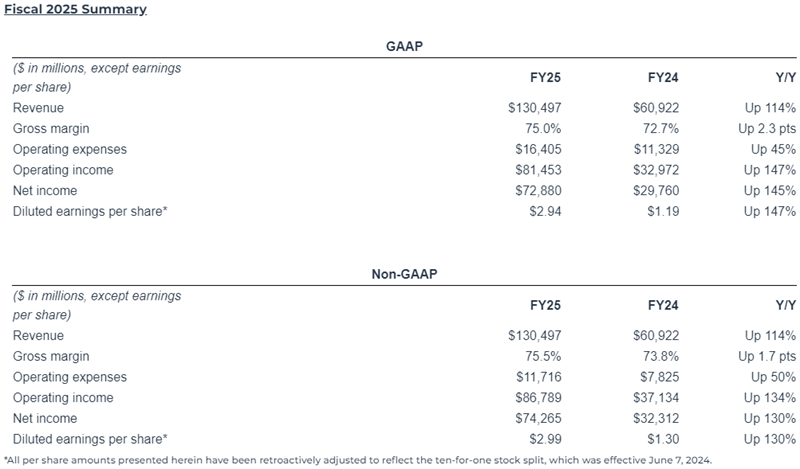

SANTA CLARA, Calif., Feb. 26, 2025 – NVIDIA (NASDAQ: NVDA) has reported record-breaking revenue for its fiscal fourth quarter and full year, driven by robust demand for its AI chips, particularly the Blackwell architecture. For the quarter ending January 26, 2025, NVIDIA's revenue surged to $39.3 billion, a 12% increase from the previous quarter and 78% year-over-year. The company also achieved a record full-year revenue of $130.5 billion, a remarkable 114% increase from fiscal 2024.

In Q4, NVIDIA's Data Center revenue reached an all-time high of $35.6 billion, marking a 16% sequential rise and a staggering 93% year-over-year growth. This was driven by the growing adoption of its Blackwell AI supercomputers, which are now a cornerstone of cloud service providers' infrastructure. NVIDIA's founder and CEO, Jensen Huang, commented, “Demand for Blackwell is amazing... AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize industries.”

However, despite impressive top-line growth, NVIDIA's gross margins for Q4 slightly declined to 73.5% from 75% in Q3. This was attributed to the transition in the Data Center segment toward more complex, higher-cost systems. In addition, Gaming revenue dipped 22% sequentially to $2.5 billion, reflecting ongoing supply constraints and product issues with the new GeForce RTX 50 series graphics cards. Nevertheless, full-year Gaming revenue grew 9%, totaling $11.4 billion.

For fiscal 2025, NVIDIA's AI-powered hardware played a crucial role in expanding its revenue streams. The company's Data Center business, in particular, saw explosive growth, with full-year revenue climbing 142% to a record $115.2 billion. Gaming and AI PC revenues grew by 9%, while Professional Visualization and Automotive & Robotics revenues also showed strong gains.

NVIDIA's strong financial performance has come at a time when demand for AI chips is accelerating, especially in China, where companies such as Tencent and Alibaba are ramping up orders for NVIDIA's H20 GPUs. This surge in demand follows the launch of the DeepSeek AI model, which has pushed the need for more AI inference chips despite initial concerns that its launch would suppress AI chip demand. DeepSeek's ability to run efficiently on H20 GPUs, even in lower-end configurations, has driven significant orders from Chinese enterprises. Analysts estimate that NVIDIA could ship over 1 million H20-equipped servers in 2024, generating upwards of $12 billion in revenue.

Looking ahead, NVIDIA has set an ambitious forecast for the first quarter of fiscal 2026, projecting revenue of $43 billion, plus or minus 2%. The company expects its AI-driven growth to continue, bolstered by the expansion of Blackwell production and new advancements in AI-driven hardware. With the introduction of Blackwell Ultra later this year, NVIDIA is poised to maintain its leadership in the AI and data center markets.

While NVIDIA's stock saw a brief dip following DeepSeek's debut, the ongoing surge in AI adoption has helped the company recover most of its losses, with its stock down only 3% year-to-date. NVIDIA's resilience, bolstered by its strong market position and innovative products, signals continued growth as the company leads the charge in the AI revolution.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday