-advertisement-

Nvidia failed to live up to investor hopes with its latest results on August 28, delivering an underwhelming forecast and news of production snags with its much-awaited Blackwell chips.

Third-quarter revenue will be about $32.5 billion, the company said. Though analysts had predicted $31.9 billion on average, estimates ranged as high as $37.9 billion.

Heading into the announcement, there was concern that Nvidia was having problems with its new Blackwell design. The company acknowledged that there were issues with production, saying that it was making changes to improve its manufacturing yield — the number of functioning chips that come out of factories. At the same time, the company said it expects to bring in “several billion dollars” of revenue in the fourth quarter from the product.

Supplies will be plentiful after manufacturing gains momentum, Chief Executive Officer Jensen Huang said later during a Bloomberg Television interview. “We’re going to have lots and lots of supply, and we will be able to ramp,” he said.

Most of Nvidia’s growth also has come from a small group of customers. About 40% of Nvidia’s revenue stems from large data-center operators — companies like Alphabet Inc.’s Google and Meta Platforms Inc. — which are pouring tens of billions of dollars into AI infrastructure.

Though Meta and others have increased their capital expenditure budgets this earnings season, there’s been concern that the amount of infrastructure being put in place exceeds current requirements. That could lead to a bubble. But Nvidia’s Huang has maintained that this is only the beginning of a new era for technology and the economy.

Expectations were lofty. Nvidia has been the best performing stock in the S&P 500 Index this year, eclipsing gains by all other semiconductor companies. At a market value of more than $3 trillion, Nvidia is worth roughly the same amount as the next 10 largest chip firms combined.

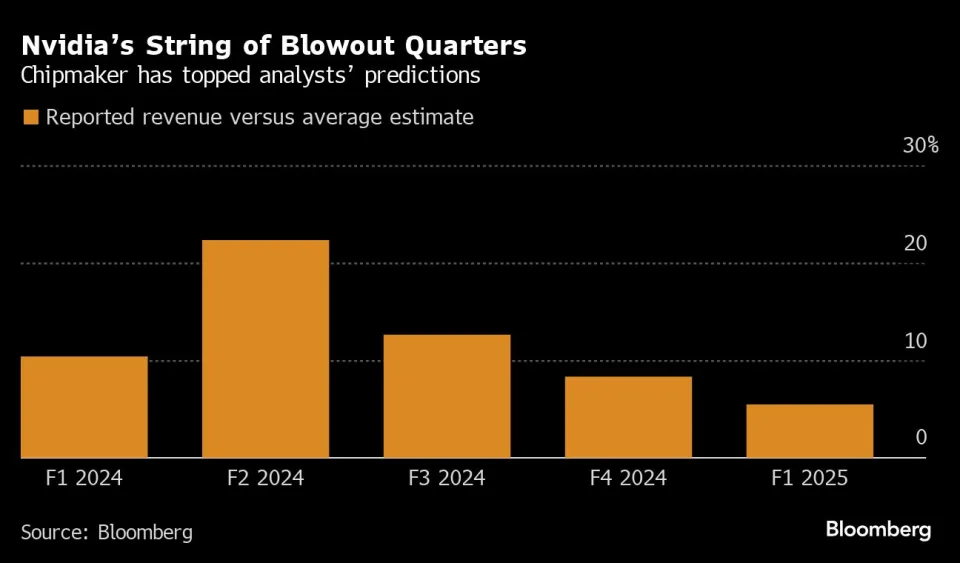

Nvidia’s revenue more than doubled to $30 billion in the fiscal second quarter, which ended July 28. Excluding certain items, profit was 68 cents a share. Analysts had predicted sales of about $28.9 billion and earnings of 64 cents a share.

Nvidia got a jump on other chipmakers because its technology was well-suited to the needs of AI. But rivals are trying to catch up. Advanced Micro Devices Inc. is now its closest competitor, with Intel Corp. — once the world’s biggest chipmaker — trailing further behind. Their combined revenue from the market is only about 5% of Nvidia’s total.

Nvidia’s data-center division — now by far its largest source of sales — generated $26.3 billion of revenue last quarter. Gaming chips provided $2.9 billion. Analysts had given targets of $25.1 billion for the data-center unit and $2.79 billion for gaming.

Blackwell is expected to generate a fresh wave of growth when it rolls out in the coming months. Analysts have downplayed concerns about delays, noting that the company still enjoys huge demand for its current generation of products. That could help Nvidia cope with any delays without a big financial hit.

In describing its challenges with Blackwell, Nvidia said it had to change a mask production step to improve its yield. A mask is the template used to burn the circuit pattern into materials deposited on a disk of silicon.

Production of Blackwell is set to ramp up in the fourth quarter and continue into the next fiscal year, Nvidia said.

Editor:Vicky

▼▼▼

Nvidia Q2 earnings blow past expectations, but shares slide after hours

Apple's India operations set to create up to 600,000 jobs by year-end

Applied Materials receives subpoena from U.S. Department of Justice, faces further scrutiny

Micron said to buy factories from AUO in deal worth up to $620M

'Black Myth: Wukong' sparks trend, boosts demand for memory and graphics cards

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday