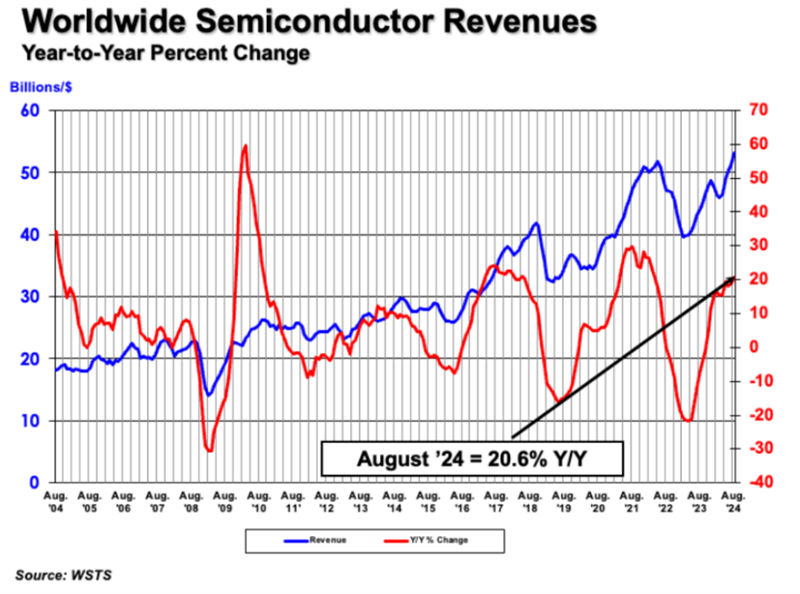

In August 2024, the global semiconductor market reached a record high of $53.1 billion in sales, driven by a surge in demand for AI-related technologies, according to the Semiconductor Industry Association (SIA). This marks a 20.6% year-on-year increase—the highest since April 2022—and a 3.5% rise from July's sales of $51.3 billion, according to data from the World Semiconductor Trade Statistics (WSTS).

SIA President and CEO John Neuffer noted, "Semiconductor sales continued their upward trend in August, reaching an all-time high for the month. The market saw the largest year-over-year growth since April 2022, particularly in the Americas, where sales surged by 43.9%." Regionally, China posted a 19.2% increase, the Asia-Pacific and other regions grew by 17.1%, and Japan saw a modest 2% rise. Europe, however, experienced a 9% decline.

Month-over-month, semiconductor sales grew across all regions, led by the Americas with a 7.5% increase, followed by Japan (2.5%), Europe (2.4%), China (1.7%), and the Asia-Pacific (1.5%).

The semiconductor industry's resurgence since Q2 2024 has been driven by the explosive demand for AI, which requires advanced chips produced through cutting-edge manufacturing processes. Companies like Nvidia, Google, and Apple have significantly increased their demand for high-performance chips from leading foundries like TSMC, pushing prices higher.

As the world’s largest contract chip manufacturer, TSMC has a strong influence on pricing in the advanced semiconductor market. Reports suggest that TSMC is preparing to raise its prices for 3nm chips by around 5%, starting in 2025, due to tight supply and high demand. TSMC's advanced production capacity utilization has steadily increased since the second half of 2023, reaching near full capacity in early 2024.

TSMC is also making significant advancements with its 2nm process, introducing Gate-All-Around (GAAFET) transistor technology and NanoFlex technology, which offers unprecedented flexibility for chip designers. The new N2 process is expected to improve performance by 10-15% or reduce power consumption by 25-30% compared to the current N3E process. Additionally, transistor density will increase by 15%, marking another breakthrough for TSMC.

However, with these technological advancements come rising costs. The price for a 300mm 2nm wafer is expected to exceed $30,000, up from earlier estimates of $25,000. In comparison, current 3nm wafers range from $18,500 to $20,000, and 4/5nm wafers are priced between $15,000 and $16,000. This price increase reflects the complexity of the 2nm process and growing demand for next-gen chips.

To meet this demand, TSMC is heavily investing in its 2nm production facilities, with plans to expand across Taiwan, including Hsinchu, Taichung, and Kaohsiung. The N2 process is expected to enter mass production in late 2025, with the first chips likely to be delivered to tech giants like Apple by 2026.

TSMC isn't the only player in the 2nm race. Samsung and Intel are also ramping up efforts in sub-2nm processes. Samsung plans to mass-produce 2nm chips by 2025, targeting high-performance computing (HPC) in 2026 and automotive applications in 2027. Meanwhile, Intel has secured ASML’s cutting-edge 0.55 numerical aperture EUV lithography machines, which will be used for its Intel 18A node and future process technologies.

With billions of dollars being invested in new fabs, the competition to be the first to mass-produce 2nm chips is heating up. The company that succeeds will lead the next technological revolution in semiconductor manufacturing.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday