The global semiconductor market, including storage, is expected to grow by 19% year-on-year in 2024, reaching $621 billion, according to Counterpoint Research. This marks a strong recovery following a slump in 2023, fueled by a surge in AI demand, a rebound in storage chip demand, and rising prices. However, the logic semiconductor market, excluding AI-related chips, is only seeing a mild recovery.

In particular, the global memory chip market is projected to soar by 64% in 2024, driven by higher demand and price increases. The growth of high-bandwidth memory (HBM) for AI applications further supports the memory sector. Meanwhile, the global logic semiconductor market is expected to grow 11%, boosted by the key role of GPUs in AI model training. Although demand in automotive and industrial markets remains weak, there are signs of recovery, which will contribute to the overall market growth.

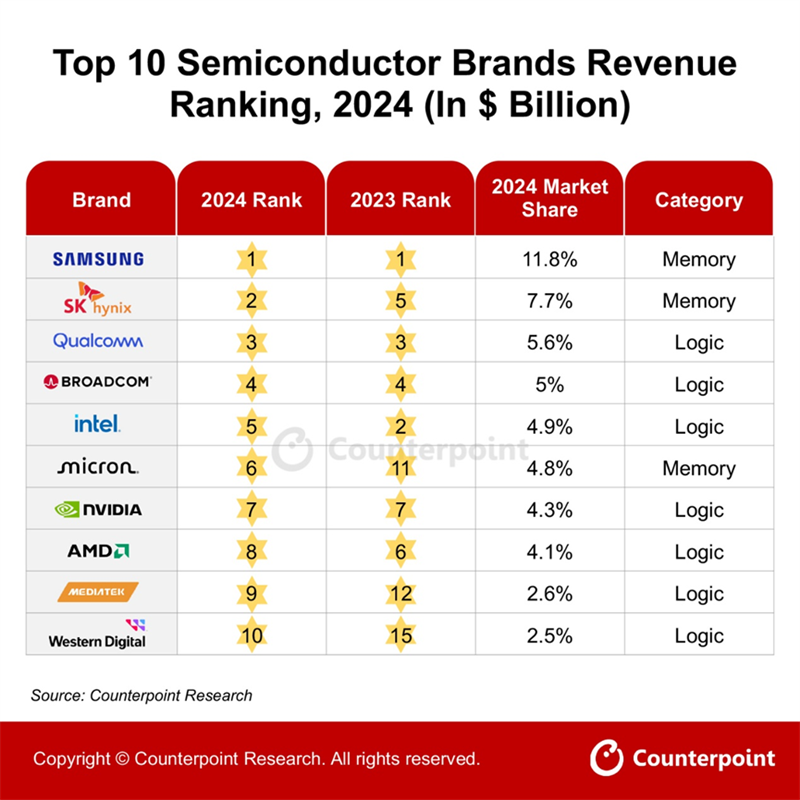

According to Counterpoint's 2024 ranking of the top 10 global semiconductor companies by revenue, Samsung Electronics leads with an 11.8% market share, followed by SK hynix (7.7%), Qualcomm (5.6%), Broadcom (5%), Intel (4.9%), Micron (4.8%), Nvidia (4.3%), AMD (4.1%), MediaTek (2.6%), and Western Digital (2.5%). Notably, this ranking includes only companies with proprietary brands like Nvidia and Qualcomm, excluding foundries such as TSMC and UMC.

Counterpoint notes that Samsung's market leadership is driven by rising storage chip demand, price hikes, inventory restocking in its smartphone business, and new AI and high-performance computing clients. However, the company faces challenges like HBM3e delays and competition in low-end memory.

Both SK hynix and Micron benefit from the same trends, especially AI-driven demand for HBM. Qualcomm, ranking third with a 5.6% market share and 14% revenue growth, is seeing gains from a recovery in Android smartphones and growth in automotive applications, though IoT demand is still sluggish.

Intel, ranked fifth, faces challenges due to weak demand in PC and server markets, intensifying competition.

Counterpoint analysts emphasize that the U.S. remains the epicenter of the semiconductor industry, with leading companies driving global innovation and market growth. As AI and high-performance computing needs continue to rise, U.S. semiconductor leaders are poised to play a crucial role in future market competition.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday