-advertisement-

The era of AI began in earnest in 2023, with big tech companies joining the competition for high-performance semiconductor chips, which now play a crucial role in AI, big data, autonomous driving, and gaming.

MarketsandMarkets predicts the glass substrate market, spurred by Apple, AMD, and Intel's adoption, to reach $8.4 billion (approximately 60.8 billion yuan) by 2028, presenting a lucrative, competitive frontier for corporations.

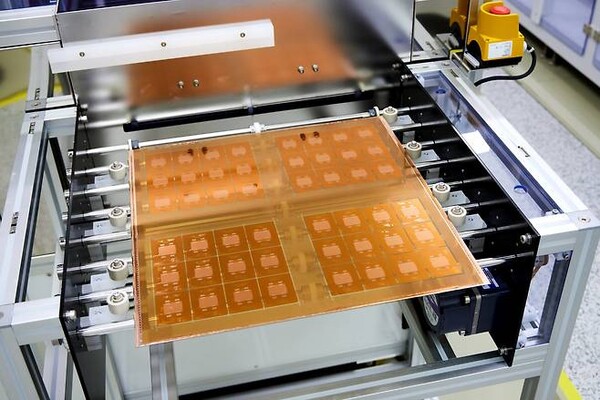

Glass substrate produced by Absolics

Recently, the U.S. government committed a first-ever 100 billion KRW (approximately 531 million yuan) subsidy to SKC's investment arm, Absolics, signifying its recognition of glass substrates as a game-changing component in the semiconductor industry.

Absolics is projected to take the lead in the glass substrate market, aided by the early adoption of its business and the planned enhancement of its manufacturing capacity. The firm plans to wrap up performance tests and pilot runs at its first Georgia plant by the end of 2024, kick-starting full-scale manufacturing by the first half of 2025.

According to Absolics of SKC, plant No.1 will adopt Small Volume Manufacturing (SVM), and plant No.2 will adopt High Volume Manufacturing (HVM) to expand its global market dominance. The production of plant No.1 is expected to be 12,000 ㎡ per year, and the production of plant No.2 is estimated to be 5 to 20 times more than that of plant No.1.

If Absolics spearheads the glass substrate field, a potential synergy with SK Hynix, the world's first developer of AI high-bandwidth memory (HBM), is anticipated, which would significantly bolster semiconductor capabilities.

Samsung Electro-Mechanics and LG Innotek have also jumped into the glass substrate business one after another. Samsung Electro-Mechanics plans to introduce glass substrate pilot line equipment in September 2024, and LG Innotek is recruiting development personnel in the CTO division to lead the glass substrate business.

These lightweight, flexible substrates offer potential for innovative design in displays and wearables. Moreover, they enhance the durability of devices and improve user experiences by providing clearer, vivid screens.

As essential components in the semiconductor and display industries, their significance is escalating through technological advances. With continued development, these substrates influence the thermal stability and performance of semiconductor devices. Amidst surging digital data production rates, these companies are strengthening their global competitiveness in the field.

Editor:Lulu

▼▼▼

New chairman at printed circuit board association of America

Industry mourns European PCB expert Michael Gasch

DuPont announces plan to separate into three independent, publicly traded companies

Tesla pushes suppliers to produce parts outside of China and Taiwan

Eltek Ltd. experienced revenue growth in 2024 Q1 and set its sights on North American expansion

E&R Engineering Corp. has become the designated equipment supplier for Intel

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday