A powerful 6.4-magnitude earthquake struck Taiwan on January 21, 2025, causing significant disruptions at Taiwan Semiconductor Manufacturing Company (TSMC). Despite ensuring the safety of all personnel and confirming no structural damage to its facilities, the quake severely impacted production at key fabs, resulting in an estimated 60,000 wafers being scrapped.

Impact on Key Fabs

TSMC's Fab 18, a critical facility for 3nm and 5nm chip production located in the Southern Taiwan Science Park, experienced machinery displacements affecting 30–40% of its equipment. According to estimates, Fab 18A and Fab 18B saw between 25,000 and 30,000 wafers damaged due to the equipment shifts. Given Fab 18's importance for advanced chip manufacturing, these losses are particularly significant.

The situation at Fab 14, which produces 12-inch wafers for older-generation nodes, was even more severe. Supply chain sources revealed that approximately 50% of Fab 14's equipment was affected, with over 30,000 wafers scrapped across Fab 14A and Fab 14B. The extent of damage to both fabs has created substantial challenges in restoring production, particularly at Fab 14, where a timeline for resumption has yet to be confirmed.

Financial and Operational Impact

The combined wafer losses at Fab 18 and Fab 14 are estimated to exceed NT$3 billion (approximately $91.5 million). While TSMC has mobilized repair teams and suppliers to address equipment displacements and minimize downtime, production delays could temporarily impact shipments to major clients such as NVIDIA, AMD, and Intel.

Resilience Amid Disruption

Despite the challenges, TSMC's facilities are designed to withstand earthquakes up to magnitude 7, and the company remains confident in its recovery efforts. Fab 18 is expected to resume full production by January 23, while recovery efforts at Fab 14 are ongoing. Insurance coverage is also expected to offset some of the financial losses.

Record Financial Performance in 2024

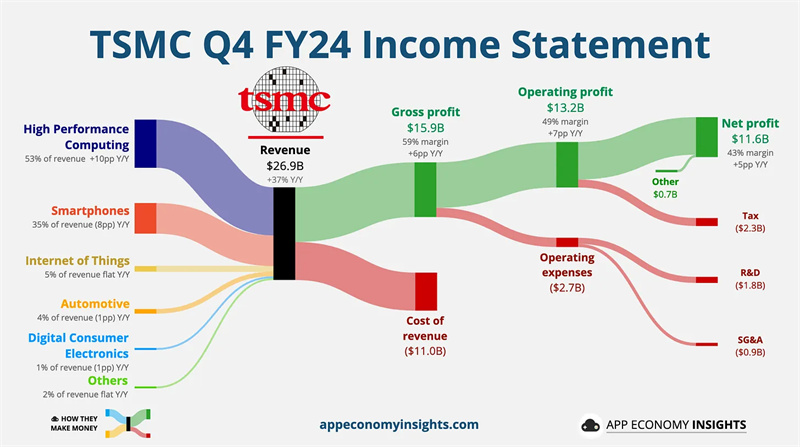

The disruption comes on the heels of a record-breaking year for TSMC. In 2024, the company reported $90.08 billion in revenue, a 30% year-over-year increase, and $36.48 billion in net income, up 31.1%. In Q4 alone, advanced nodes (7nm and below) accounted for 74% of total revenue, with 3nm processes contributing 26% and 5nm contributing 34%.

Outlook

While the earthquake has posed short-term challenges, TSMC's strong financial position and swift response highlight its resilience. The company's efforts to restore production are expected to mitigate long-term disruptions, maintaining its leadership in the global semiconductor industry.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday