-advertisement-

The global foundry industry’s revenue grew about 9% QoQ and 23% YoY in Q2 2024, according to Counterpoint Research’s Foundry Quarterly Tracker, published on August 20, 2024. The sequential growth was mainly driven by strong AI demand. CoWoS supply remained tight, with potential upsides in capacity expansions focusing on CoWoS-L going forward.

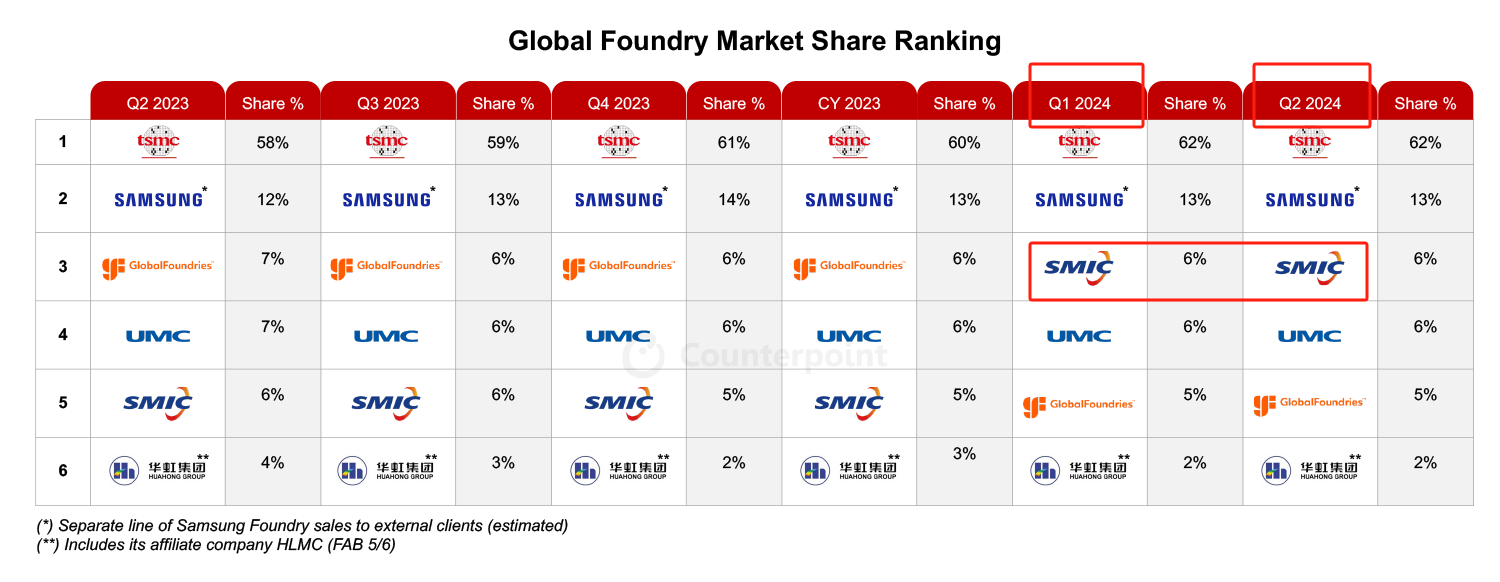

Notably, China’s foundry and semiconductor market saw a faster recovery compared to global peers. Chinese foundry players such as SMIC and HuaHong delivered strong quarterly results and positive guidance, as China’s fabless customers entered the inventory correction phase earlier, bottoming out sooner than their global counterparts. China's largest chipmaker, the state-backed SMIC has held the position of the world's third-largest foundry for two consecutive quarters.

TSMC delivered a mild quarterly revenue beat in Q2 2024, driven by continuing strong growth in AI accelerator demand. As a result, TSMC further revised its annual revenue guidance to mid-20% from low-to-mid 20% earlier. Besides, TSMC expects the demand-supply balance for AI accelerators to remain tight through late 2025 or early 2026.

Samsung Foundry’s revenue increased sequentially primarily due to inventory pre-build and restocking for smartphones, maintaining its second position with a 13% market share in Q2 2024. The company continues to focus on securing more mobile and AI/HPC customers for advanced nodes and expects its annual revenue growth to outpace industry growth.

SMIC’s quarterly results were strong, and the company provided stronger-than-expected guidance for Q3, driven by continued demand recovery in China, including for CIS, PMIC, IoT, TDDI and LDDIC applications. SMIC’s 12” demand is improving, and blended ASP (average selling price) is expected to increase as inventory restocking broadens among Chinese fabless customers.

Counterpoint Research Analyst Adam Chang said, “In Q2 2024, the global foundry industry demonstrated resilience, with most of the growth primarily driven by robust AI demand and smartphone inventory restocking. Demand recovery across the semiconductor industry is progressing unevenly. While leading-edge applications such as AI semiconductors are experiencing strong growth, traditional semiconductors are recovering more slowly. Chinese foundries are rebounding faster due to earlier inventory corrections and increased restocking by local fabless customers. In contrast, non-Chinese foundries are experiencing a more gradual recovery.”

Editor:Vicky

▼▼▼

Intel aims to cut Sales and Marketing Group costs by 35% this year

Chipmaker Microchip hit by cyberattack, slowing operations

AMD to acquire server builder ZT Systems for $4.9 billion in cash and stock

TSMC factory begins construction in Germany

Chip company Inuitive laying off 20% of workforce as CEO retires

South Korean AI chip makers Rebellions and Sapeon agree to merge

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday