-advertisement-

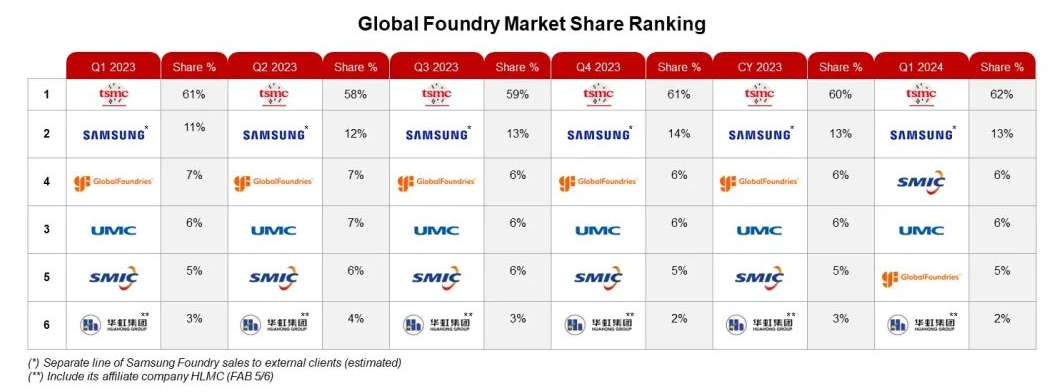

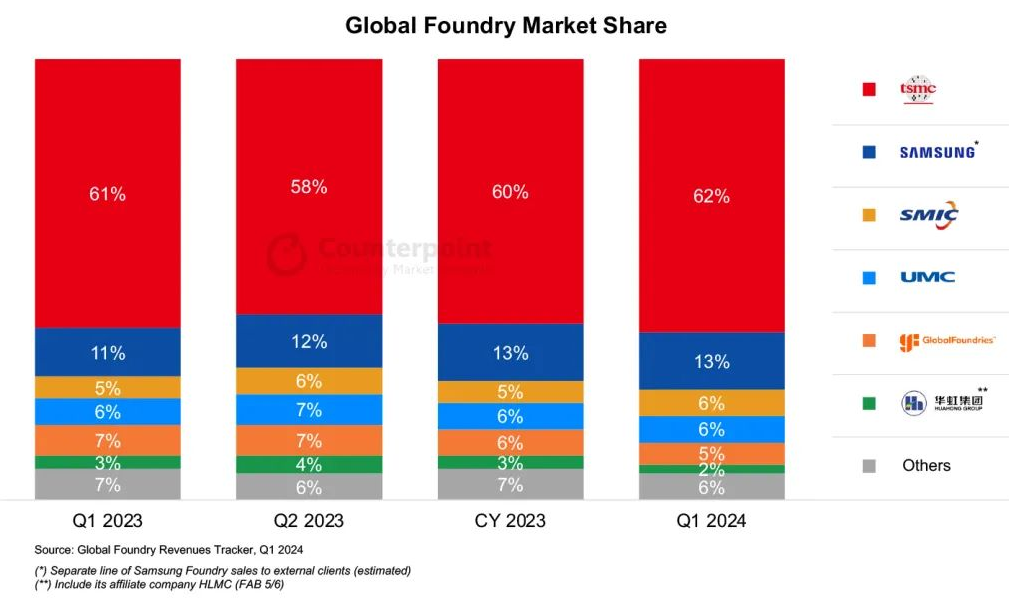

China's largest chipmaker, the state-backed Semiconductor Manufacturing International Co. (SMIC), has made headlines as it ascends to be the world's third-largest foundry in terms of revenue for the first quarter of 2024, as reported by Counterpoint Research on May 22nd. This pivotal victory sees SMIC, holding a market share of 6% in the first quarter — an increase from 5% last year, overtake GlobalFoundries and Taiwan's United Microelectronics Corporation.

According to the Counterpoint Research report published, "SMIC's quarterly results surpassed market expectations, and the company secured the No. 3 position in foundry revenue market share in Q1 2024 for the first time, as demand recovery begins in China, including CIS, PMIC, IoT, and DDIC applications." The chips they manufacture are pivotal to an array of products such as automobiles, smartphones, computers, and IoT technologies.

SMIC's first-quarter revenue was a hefty $1.75 billion, showing an upturn of 19.7% from the previous year, as consumers hoarded chips. SMIC's influence is most prolific in China with over 80% of the revenue for the quarter being derived internally. With strong demand predicted, the company expects revenue to rise by 5% to 7% in the second quarter.

China, which is the world's largest assembly market for consumer devices, consumes nearly 50% of its semiconductors, as reported by tech consultancy Omdia. In a bid to boost domestic manufacturing, Beijing has injected billions of yuan in subsidies into chip firms like SMIC, vital to its ambition to lessen dependence on overseas technology.

However, the path has not been devoid of challenges. SMIC has been subject to U.S. sanctions since 2020, which restricts its ability to acquire certain American tech. This impasse has also led to SMIC's failure to secure extreme ultraviolet lithography machines — a domain monopolised by Dutch firm ASML. These machines are pivotal for the large-scale, cost-effective production of high-tech semiconductors.

Despite U.S. sanctions, SMIC has demonstrated resilience. A teardown of Chinese tech giant Huawei's Mate 60 Pro smartphone launched last year revealed the phone was powered by a 7-nanometer chip made by SMIC, seemingly supporting 5G connectivity contrary to U.S. attempts to cut Huawei off from key technologies including 5G chips.

Analysts, however, warn that SMIC still has gaps to close with Taiwan Semiconductor Manufacturing Company and South Korea's Samsung Foundry, holding market shares of 62% and 13% respectively in Q1 2024.

On an optimistic note, the race to minuscule nanometer size, which equates to an advanced and efficient chip, is still on. TSMC and Samsung have managed to mass-produce 7-nanometer chips since 2018 and have currently ventured into the production of 3-nanometer chips. As pursuits of tech advancements continue, SMIC's journey in this global semiconductor industry is one to watch.

Editor:Lulu

▼▼▼

Nvidia cuts China AI chip prices amid competition from Huawei

South Korea announces $19 billion support package for chip industry

Tesla's oldest factory ignites another headline by catching fire

Samsung Electronics names new chief for semiconductor business as AI chip race heats up

Tokyo Electron plans to set aside $1.6 billion for R&D this year

US semiconductor giant Marvell Tech launches third office in Vietnam

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday