-advertisement-

Chinese semiconductor-related companies pulled out all the stops at one of the country's largest chip-sector fairs this week to pitch domestic buying, echoing Beijing's call to galvanize support for an industry facing growing geopolitical strains.

The message was plastered across booths and marketing materials of a variety of companies, from chip equipment makers to materials producers. These included Vel-Tec Semiconductor, a Kunshan-based firm that makes photoresist coating equipment, and Shenzhen-listed Jingsheng (300316.SZ),which manufactures machines used for processing silicon wafers.

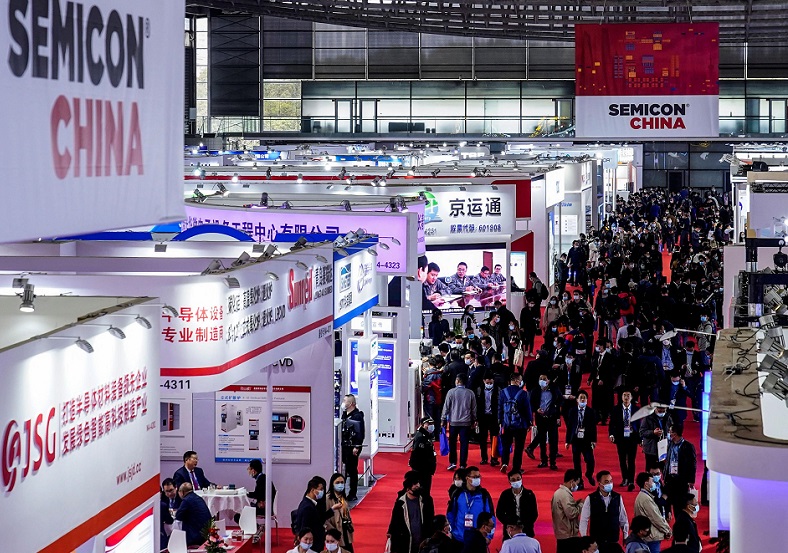

Over a dozen Chinese exhibitors at the annual SEMICON China show in Shanghai that to said their products could be used as replacement for foreign-made ones. Staff from foreign firms that were represented said that while there was still a gap in quality and efficacy, Chinese rivals were quickly catching up.

"'Buy local' and getting supply chains out of US control was a clear focus of many at the show," said Cameron Johnson, a Shanghai-based senior partner at consultancy Tidalwave Solutions, who has attended SEMICON since 2016.

The three-day show provided a glimpse into the mood of the Chinese semiconductor industry, which has been hit with multiple export curbs from the U.S. and its allies. Washington says it does not want to see advanced chips and related technology end up in the hands of the Chinese military.

Such pressure has spurred calls from Beijing to its domestic chip industry to catch up faster with foreign countries and to become more self-reliant. China has poured billions of dollars into the effort but the complexities and globally interconnected nature of the chip supply chain has meant that a big gap still exists, analysts say.

Few U.S. firms turned up at the event that attracted 1,100 exhibitors and large crowds of visitors though there were several Japanese, South Korean, and Taiwanese companies. Big Chinese names such as the country's largest foundry, SMIC (0981.HK), were also absent.

A Beijing-based salesperson, surnamed Ye, representing a Japanese company that makes materials used in chipmaking, said Chinese rivals are rapidly closing the gap in material areas that do not require cutting-edge technology.

"Formulating material prescriptions is a major entry barrier, but Chinese companies are learning quickly and overcoming this hurdle," he said.

This is because more manufacturing facilities are willing to use materials prescribed by Chinese firms, a trend that has certainly been accelerated by U.S. sanctions, he said.

Chinese companies are also gaining more orders against foreign rivals in the equipment sector, according to Ye, who said he deals with many Chinese semiconductor equipment makers.

An attending salesperson from a Shenzhen-based firm that makes testing equipment used throughout all processes of chipmaking said Chinese firms had cost advantages and his firm's highest-end product is now being sold at just one-third of the price of its Japanese rivals.

Because of the cost advantage, manufacturing facilities and clients tend to prioritise domestic firms for production lines in newly opened plants, he said, asking not to be named as he has been told not to speak to media.

In some cases, they even replace foreign equipment with domestic alternatives in older production lines, he added.

▼▼▼

Dutch high tech firm VDL to build a new semiconductor factory in Vietnam

SK Hynix earmarks $91 bn to construct world's largest chip fab

Biden announces $8.5 billion federal investment in Intel computer chip plants

Astera Labs seeks to raise around $713 mln in IPO at $5.5 bln valuation

Infinera Corporation Announces Notification of Delinquency with Nasdaq

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday