Aspocomp Group Plc, a PCB manufacturer and supplier with its own factory in Finland and a partner network in Europe and China has released its interim report on April 20, 2023

FIRST QUARTER 2023 HIGHLIGHTS

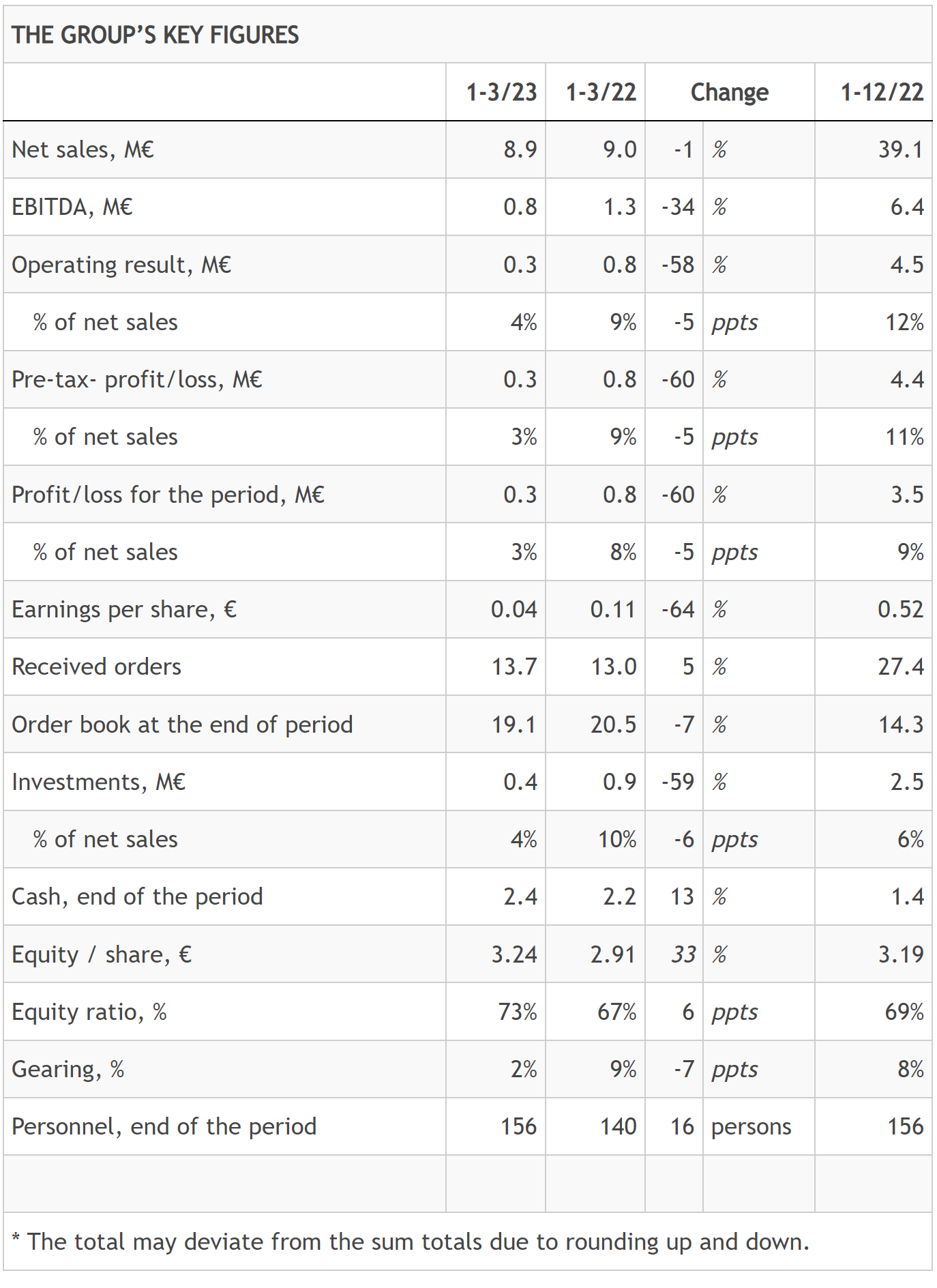

Net sales EUR 8.9 (9.0) million, decrease of 1%

Operating result EUR 0.3 (0.8) million, 3.8% (8.9%) of net sales

Earnings per share EUR 0.04 (0.11)

Operative cash flow EUR 1.6 (0.7) million

Orders received EUR 13.7 (13.0) million, increase of 5%

Order book at the end of the review period EUR 19.1 (20.5) million, decrease of 7%

Equity ratio 72.9% (66.9%)

OUTLOOK FOR 2023

Inflation and interest rates, the risk of recession and the uncertainties posed by Russia’s war of aggression will affect the operating environment of the company and its customers in the financial year 2023. The cycle of the Semiconductor Industry segment is expected to return to growth in the second half of the year.

Aspocomp estimates that its net sales for 2023 will increase from 2022 and its operating result for 2023 will be at the same level as in 2022. In 2022, net sales amounted to EUR 39.1 million and the operating result to EUR 4.5 million.

CEO’S REVIEW

“The net sales for the first quarter of 2023 amounted to EUR 8.9 million, i,e., nearly at the level of the comparison period. The development of net sales was mainly affected by the slowdown of the semiconductor cycle, but also by other uncertainties in the operating environment that slowed down investment decisions in various industries. Orders received increased by 5% to EUR 13.7 million, as a result of which our order book strengthened significantly from the turn of the year and amounted to EUR 19.1 million. We consider the turnaround seen in the order book as the first signal that the semiconductor cycle will pick up again in the second half of 2023, in line with our previous estimate.

Aspocomp’s market situation varied somewhat by customer segment in the first quarter. The Semiconductor Industry segment’s net sales growth continued, although clearly at a slower rate than in the first quarter of 2022. The Automotive segment’s net sales turned to growth as the component shortage eased. In the Industrial Electronics segment, the challenges of the operating environment, such as the development of inflation and the fear of a deepening recession, hindered investment decisions. This was also reflected in the demand for Aspocomp’s products. In the Security, Defense and Aerospace customer segment, we continued to engage in proactive sales work, but due to long order cycles, the segment’s net sales did not yet return to growth during the first quarter.

Aspocomp’s operating result for January-March decreased to EUR 0.3 (0.8) million, 3.8 percent of net sales. The changes in product mix during the quarter and especially the smaller than usual share accounted for by quick-turn deliveries weakened the operating result. In addition, higher personnel costs related to preparations for the company’s growth and one-time wage increases resulting from the outcome of collective bargaining negotiations weighed on the result. We transfer cost increases resulting from changes in the business environment to our product prices.

Inflation and interest rates, the risk of recession and the uncertainties posed by the Russian war of aggression affect the operating environment of the company and its customers in the financial year 2023. The cycle of the Semiconductor Industry segment is expected to return to growth in the second half of the year. We estimate that Aspocomp’s net sales for 2023 will increase from 2022 and its operating result for 2023 will be at the same level as in 2022. In 2022, net sales amounted to EUR 39.1 million and the operating result to EUR 4.5 million.”

NET SALES AND EARNINGS

January-March 2023

First-quarter net sales amounted to EUR 8.9 (9.0) million. Net sales decreased by 1 percent compared to the previous year due to the slowdown of the semiconductor cycle and other uncertainties related to the operating environment, which slowed down investment decisions in various industries.

The Semiconductor Industry customer segment’s net sales increased by 31% to EUR 3.7 (2.8) million during the first quarter. The collapse of the semiconductor cycle can be seen as a slowdown in growth, as the segment’s net sales quadrupled in the comparison period.

The Industrial Electronics customer segment’s net sales decreased by 52% to EUR 0.8 (1.7) million during the first quarter due to the continuous slowing effect of inflation and the threat of recession on customer investments.

The Security, Defense and Aerospace customer segment’s net sales decreased by 7% to EUR 1.4 (1.5) million. In the segment, the number of customer contacts increased, but the order cycles are long, and the results are visible with a delay.

The Automotive customer segment’s net sales increased by 18% to EUR 2.0 (1.7) million. The Automotive segment’s sales turned to growth as the component shortage eased.

The Telecommunication customer segment’s net sales decreased by 21% to EUR 1.1 (1.3) million. The net sales of the customer segment remained low due to the timing of the customers’ product development projects.

The five largest customers accounted for 61% (53%) of net sales. In geographical terms, 85% (90%) of net sales were generated in Europe and 15% (10%) on other continents.

The operating result for the first quarter amounted to EUR 0.3 (0.8) million. The changes in product mix during the quarter and especially the smaller than usual share of quick-turn deliveries weakened the operating result. In addition, higher personnel costs related to preparations for the company’s growth and one-time wage increases resulting from the outcome of collective bargaining negotiations weighed on the result.

First-quarter operating result was 3.8% (8.9%) of net sales.

Net financial expenses amounted to EUR 0.0 (0.0) million. Earnings per share were EUR 0.04 (0.11).

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday