Record Revenue and Market Performance

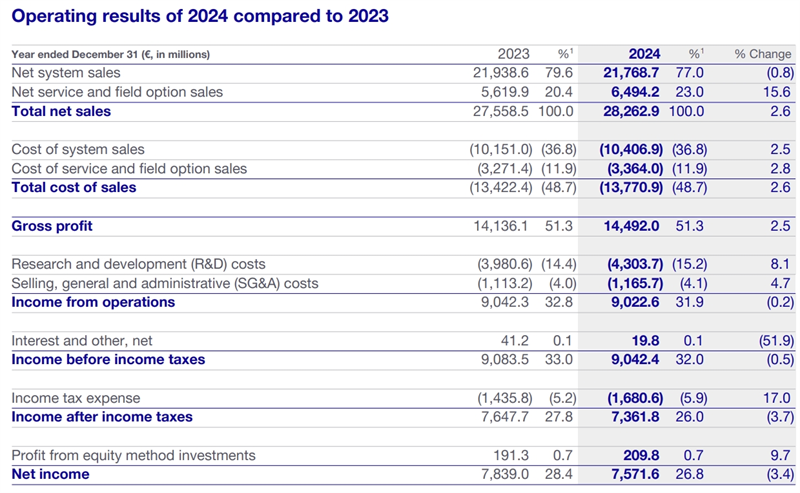

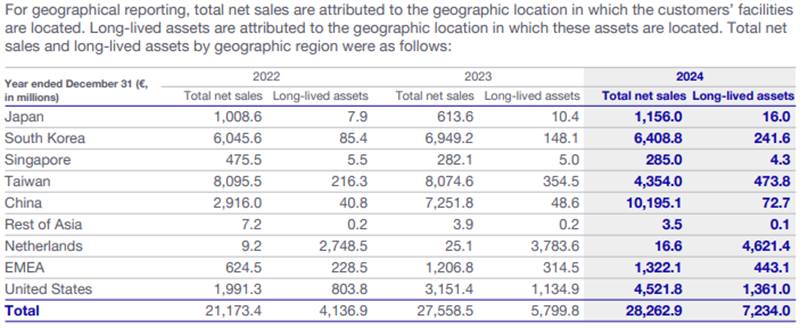

On March 5, 2025, ASML, the global leader in photolithography systems, released its 2024 annual report, revealing a record net sales figure of €28.26 billion, a 2.6% year-on-year increase. China remained ASML’s largest market, contributing €10.195 billion (36.1% of total revenue), far ahead of other regions. Other key markets included South Korea (€6.409 billion, 22.7%), the United States (€4.52 billion, 16.0%), and Taiwan (€4.354 billion, 15.4%).

In 2024, ASML sold 583 systems globally, including 44 EUV lithography machines, 374 DUV lithography systems, and 165 metrology and inspection systems. Despite a 3.4% decline in net income to €7.571 billion, the company maintained a strong gross margin of 51.3%.

China’s Growing Market Share and ASML’s Commitment

China’s contribution to ASML’s revenue surged to 36.1%, up nearly 10 percentage points from 2023, driven by robust demand for DUV systems. ASML has emphasized that it will continue providing maintenance services in China, despite previous reports suggesting uncertainty over its ability to operate due to expired licenses. On March 7, ASML publicly reaffirmed its commitment to servicing the Chinese market, clarifying that its planned Beijing facility is not a new repair center but an expansion and upgrade of the existing one.

Given that nearly half of ASML’s revenue comes from China, any disruption to this market could have significant consequences. The Dutch government’s export restrictions, reportedly influenced by U.S. pressure, have already created uncertainties, but ASML remains focused on minimizing disruptions and maintaining stable operations.

Market Outlook and Challenges

ASML noted a recovery in the semiconductor market following the 2023 downturn, with AI-driven demand for memory and advanced logic chips leading the growth. However, inventory adjustments in the industrial and automotive sectors have slowed overall demand. While EUV system orders have been delayed due to weak end-market demand and fab readiness, DUV systems remain oversubscribed, particularly in China.

CEO Peter Wennink explained that the high revenue share from China in 2023–2024 resulted from the fulfillment of backlogged orders from 2022. He expects China’s revenue share to return to historical levels in 2025.

Geopolitical and Export Control Impacts

ASML acknowledged the increasing challenges posed by export controls and geopolitical tensions. Since October 2022, U.S. and Dutch export restrictions have limited ASML’s ability to supply advanced EUV and certain DUV models to Chinese customers. In September 2024, the Dutch government introduced new export license requirements for certain DUV systems, further complicating ASML’s operations. Additionally, in December 2024, the U.S. expanded its export control list, restricting sales to more Chinese fabs.

Despite these restrictions, ASML continues expanding its presence in China. The company’s fixed assets in China grew from €40.8 million in 2022 to €72.7 million in 2024, while its local workforce expanded significantly. ASML also operates service centers across Asia (China, South Korea, Taiwan), the U.S. (Wilton, San Diego, Vancouver, WA), and the EU (Veldhoven), working closely with local suppliers and specialized repair partners.

Strengthening Local Operations in China

ASML’s expanded Beijing service center, set to launch in 2025, aims to enhance local repair and maintenance capabilities, reducing logistics costs and environmental impact. The company has also established a local procurement team to navigate supply chain challenges and ensure uninterrupted operations for Chinese clients.

An ASML insider stated:

“We’ve worked hard to ensure that none of our customers’ machines are idled due to export controls.”

ASML also emphasized that conducting repairs and reusing materials locally helps reduce logistics time, spare parts costs, and environmental impact.

Global Ambitions and Future Goals

ASML remains optimistic about its long-term growth, targeting annual revenues of €44–60 billion by 2030. While China’s share of sales is expected to stabilize below 20% in the coming years, the company remains committed to the region as a key market.

ASML’s strategic investments in China, alongside its efforts to navigate geopolitical complexities, underscore its commitment to maintaining a strong global presence while supporting the semiconductor industry’s continued evolution.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday