The world's top 10 semiconductor companies reported a remarkable 38% year-on-year increase in net profit for the third quarter of 2024, reaching a combined total of $30.4 billion. This marks a three-year high, with Nvidia alone accounting for 63% of the total profits, driven by booming demand tied to artificial intelligence (AI). Seven of the ten companies saw positive growth in net earnings, highlighting the strength of AI-related investments.

Nvidia, the leader in AI chips, saw its net profit soar to $19.3 billion for the August-October period, more than double from the previous year. The company holds nearly a 90% market share in graphics processing units (GPUs) used in AI systems. Revenue from AI-driven data center sales skyrocketed, making up about 90% of Nvidia's total earnings. This surge comes as global AI investments continue to rise, with companies relying heavily on AI for server and data processing needs.

Advanced Micro Devices (AMD), the second-largest GPU player, also reported strong results. Its third-quarter net profit hit $771 million, up 2.6 times from the same period last year. AMD's CEO Lisa Su emphasized the "insatiable demand for more compute" driving growth, with the company on track to deliver record revenue in 2024. Meanwhile, high-bandwidth memory (HBM) suppliers, including SK Hynix and Samsung Electronics, also saw significant profits, fueled by the growing demand for AI applications. Hynix announced that its HBM supply is sold out through 2024, while Samsung's profits surged by 72% thanks to the recovery in the memory market.

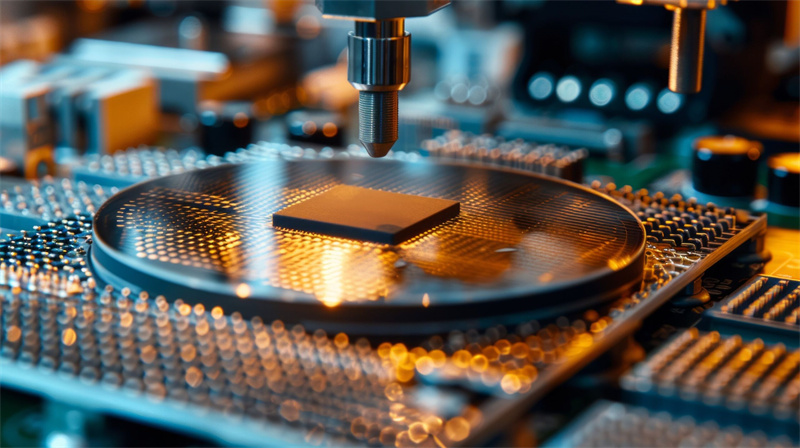

Taiwan Semiconductor Manufacturing Co. (TSMC), the top chip foundry, posted a record net profit, benefiting from its strong position in AI chip manufacturing. The company continues to see robust demand for AI-related chips, as Nvidia and AMD rely on TSMC's advanced chipmaking capabilities.

However, not all semiconductor companies shared in the prosperity. Intel, a major player in CPUs, posted a record quarterly loss of $16.6 billion amid weak demand. Similarly, Texas Instruments and STMicroelectronics saw declines in profits, with TI noting a 20% drop in net earnings due to sluggish automotive chip demand outside of China. STMicroelectronics' profits fell by 68%, largely due to slow demand for semiconductor components used in electric vehicles (EVs).

Despite these challenges, analysts expect a strong fourth quarter for the semiconductor industry, driven by continued AI demand. The combined net profit of the top 10 semiconductor companies is projected to grow by 60% year-on-year in Q4 2024. However, experts caution that while investments in AI servers are expected to grow by 50% in 2024, the pace of growth may slow significantly in the coming years. If factors such as power shortages slow down data center investments, the semiconductor industry's growth trajectory could face greater risks in 2025 and beyond.

In summary, the semiconductor industry is enjoying an AI-driven boom, but challenges remain as certain sectors, such as automotive and traditional consumer electronics, face weaker demand. The next few years will be critical in determining whether AI investments can continue to sustain this growth in the face of potential obstacles.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday